We already benchmark our suppliers against various criteria including recycling rates and social sustainability. In 2025, we will request individual carbon footprints associated with our customers’ waste services from our suppliers and encourage them to reduce these in line with Net Zero.

For landfill, collection, transportation and landfill emissions (‘gate to grave’) are included. For combustion and recycling, GHG Protocol conversion factors consider transport to an energy recovery or materials reclamation facility only, with subsequent emissions attributed to electricity generation or recycled material production respectively. Emissions from energy recovery, recycling, composting and anaerobic digestion are attributed to the user of the recycled materials, not the producer of the waste, in line with GHG Protocol Guidelines.

Telephone and broadband services

In 2024 we launched our Telecoms directorate. Our partner in this field has an AA ESG rating from MSCI.

Technology

How we purchase and reuse laptops still has the largest impact on emissions from purchased goods and services (representing almost a third of these). It is also one of the categories most in our control. We included actions to reduce the emissions and waste associated with our use of technology (software, data and hardware) in our 2030 Sustainability Strategy.

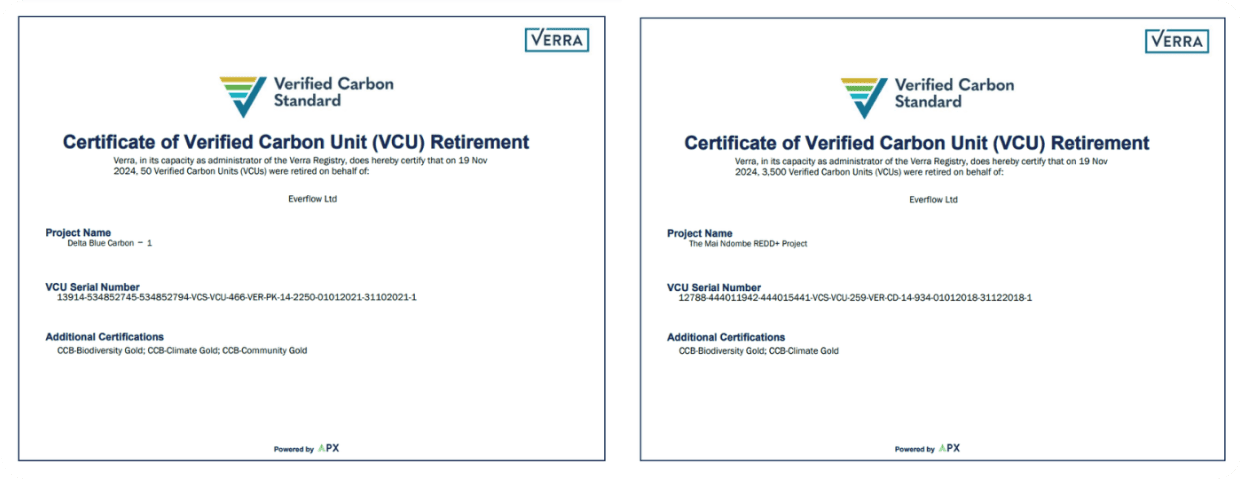

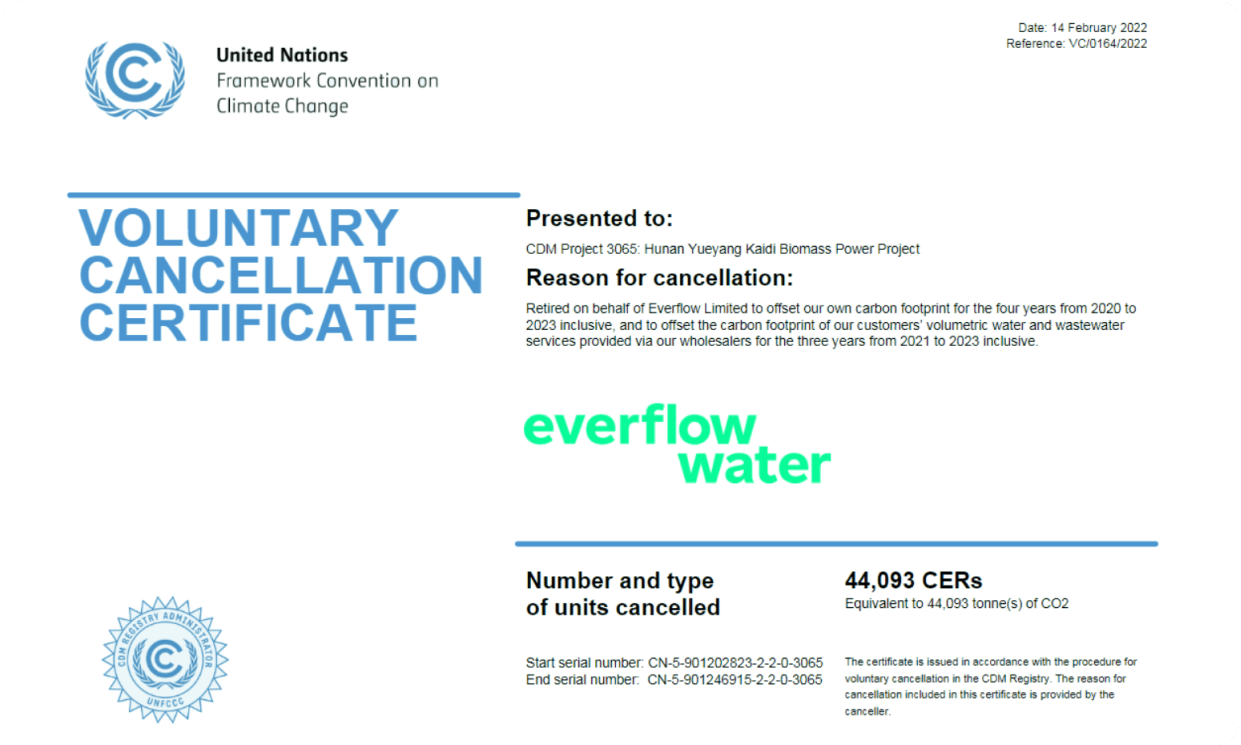

Our emissions from software subscriptions have decreased because many software suppliers are sourcing zero carbon electricity and offsetting using high quality carbon credits, so were rated 0.00 in the ONS spend based emissions factors in 2024.

Our emissions from building maintenance and construction returned to pre-2023 levels this year, because we moved to our new HQ last year.

Rates have not been included this year, as we are awaiting a business rate re-valuation for Rateable Value following refurbishment of our HQ at Peterlee.

Business travel has reduced slightly this year and employees car share when possible.

For laptops, instead of using the spend based method using UK government figures, which rates even the manufacture of laptops to be low carbon (perhaps due to zero carbon electricity and transport or offsetting), we report a figure associated with the whole life cycle of laptops. In 2024 we bought 134 laptops, and the average footprint of a laptop is calculated by Circular Computing to be 331kg. This results in a laptop footprint of 44 tonnes in 2024.

For waste, we no longer include emissions associated with our supply chain (disposal) as well as collection, because it is mostly treated and disposed of via recycling and incineration. Emissions associated with these methods are assigned to the recycled products manufactured and the energy produced, in line with the GHG Protocol. The UK government also reduced spend based factors for many disposal methods by 70% this year.

For suppliers that have not yet reported their actual emissions to us, we have had to use the spend-based method, which is based on average emissions per £1 spend for each industry SIC code of the product/service purchased.

The spend-based method results in SIC codes potentially being assigned incorrectly to suppliers and fails to reflect the impact of choosing more sustainable suppliers or asking our suppliers to measure their footprint and reduce it. Therefore, we will request carbon emissions information from our suppliers annually and provide support with calculating them.

However, as we report by calendar year and many other companies report by financial year, this would move our reporting to the end of each year and would not enable us to report our SECR with our annual accounts in Q2.

Next year we may choose to report Scope 3 emissions one year in arrears.