Everflow vulnerability strategy for business customers

1. Introduction

Everflow is committed to supporting vulnerable Non-Household (NHH) customers in the Water Retail Market. In line with Ofwat’s Customer Protection Code of Practice and guidance on vulnerability strategies, this document sets out Everflow’s approach to identifying, supporting, and monitoring vulnerable customers. This strategy is designed to be inclusive, proportionate, and evolving, ensuring business customers receive the assistance they need when they need it. It will be reviewed and updated on an annual basis to ensure its continued impact and effectiveness.

2. Understanding drivers of vulnerability

We define a vulnerable customer in line with Ofwat’s guidance: a NHH customer who, due to personal or business circumstances, may require additional support to access an inclusive service. Key drivers include:

- Financial difficulties (e.g. cash flow challenges)

- Health issues or disabilities among key individuals

- Mental health or emotional distress

- Technological or literacy barriers

- Unexpected events (e.g. business interruption, bereavement)

We acknowledge that vulnerability can be transient, situational, or permanent, and our processes are designed to reflect this understanding.

3. Identifying vulnerable customers

A self-identification feature will be available for customers through our Internal Support Register (ISR). Customers may self-identify during registration or at any point of interaction. Additionally, we will use the following methods:

- Agent observation during contact, as some customers may not feel comfortable initially sharing vulnerability (our agents will be trained to recognise signs of vulnerability)

- Proactive monitoring of accounts for financial distress indicators (e.g. sudden usage spikes, missed payments)

- Feedback and interactions that signal accessibility needs or distress

A vulnerability tag detailing the customer’s needs will then be added in our internal system to flag and support these customers consistently.

4. Staff training and awareness

We will invest in comprehensive training to ensure staff understand vulnerability:

- One-off core training for all agents on types and signs of vulnerability when interacting with customers

- Inclusion of material in new hire induction programs

- Annual refreshers via e-learning platform

- Specialist Vulnerability Agents (VA) in Collections and Customer Services teams will receive enhanced training and ongoing support

- Support materials will be available for all staff internally

5. Support offered

We will provide a range of supportive measures for vulnerable customers:

- Flexible payment plans tailored to individual needs

- Prioritised support from dedicated VAs

- Empathetic and accessible communication available (e.g., large print bills, Braille options)

- Assistance with leak or “shock” bills, even if the customer is not on the ISR

- Signposting to external organisations like Business Debtline or the Federation of Small Businesses

6. Future development plans

We aim to continuously evolve our support. Planned developments include:

- Website enhancements to clearly communicate our commitment and support options, ensuring all information is easily accessible

- Expanded accessibility features across customer touchpoints

- Design additional support pathways for ISR customers

- Increased collaboration with wholesalers to ensure physical access to infrastructure (e.g., meter relocation if needed)

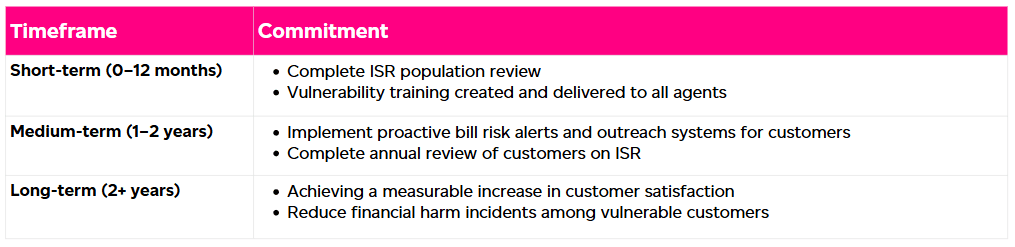

7. Targets and commitments

8. Review and improvement process

To ensure the strategy remains effective:

- The strategy is reviewed annually by a cross-functional internal working group

- The ISR is reassessed to confirm accuracy and relevance

- A feedback loop is maintained via surveys sent to ISR-registered customers

- Staff feedback and external developments are incorporated into annual updates

9. Proportionality and cost-effectiveness

Our approach is designed to be proportionate to customer needs and commercially viable. We will focus on:

- Leveraging existing platforms

- Streamlining processes through internal digital tools

- Targeted assistance to maximise impact without unnecessary overhead