2023 carbon emissions report

Total CO2e1 emitted in 2023: 1,151 tonnes

Everflow is a fast-growing, increasingly efficient business. We increased our revenue by 37% (£43.5million) in 2023 and more than doubled our profitability (+118% or £0.421m EBITDA), while increasing our FTE employees by less than half that (+14% or 21 people).

While our absolute carbon emissions decreased – our revenue increased more than three times faster. As a growing business, the best way to understand whether our carbon reduction efforts are working is by monitoring intensity metrics, as below. We reduced our total Scope 1, 2 and 3 emissions per £million in sales revenue by 45% and per £million in EBITDA by 65%. Our emissions per employee increased by 46%.

| Tonnes | CO2e | ||

| Emissions per | 2023 | 2022 | Change |

| FTE employee (172)* | 0.38 | 0.26 | +46% |

| m2 office space* | 0.028 | 0.026 | +6% |

| £m sales revenue | 7.20 | 13.10 | -45% |

| £m EBITDA | 1481 | 4287 | -65% |

*Excludes Scope 3 emissions

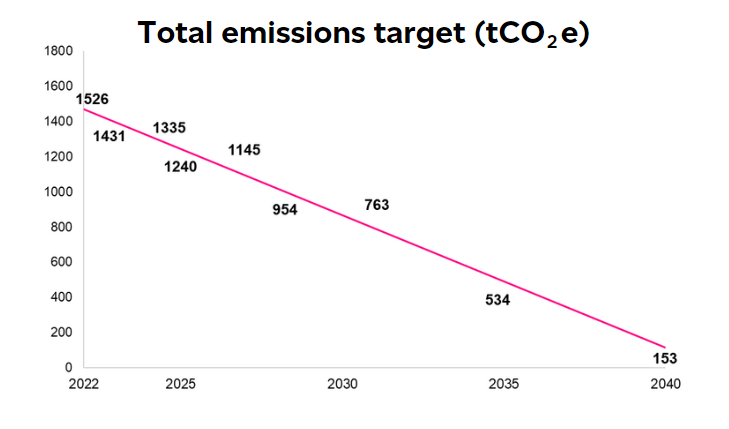

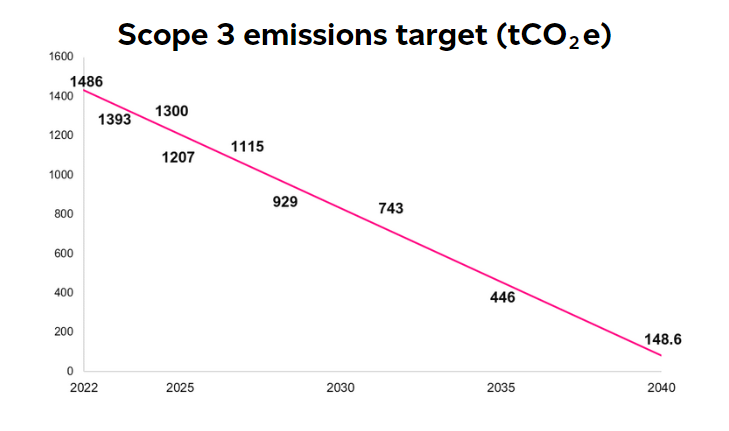

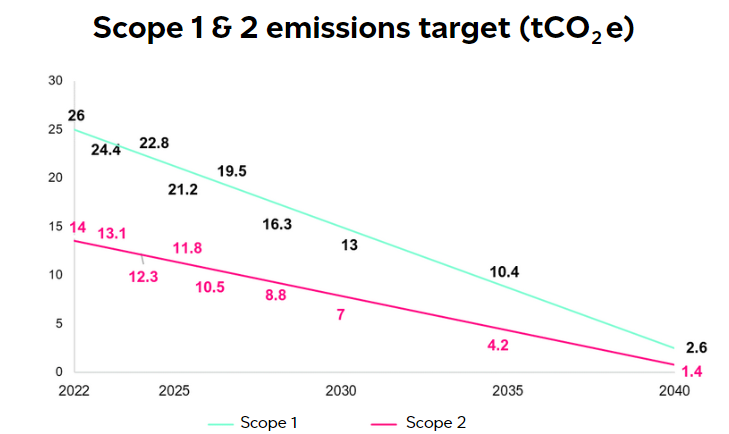

We are committed to the Climate Pledge to reduce our absolute emissions by at least 90% before 2040, and offset our remaining emissions (Net Zero). This is our third year of reporting GHG emissions figures, but our base year was redefined to 2022, so we will compare it against this year only, as well as against our target trajectory towards Net Zero by 2040. We already offset all our emissions because we understand the need to do this while we are reducing them (The Oxford Principles for Net Zero Aligned Carbon Offsetting include engaging suppliers now to build capacity for offsetting in time for Net Zero).

We have not included emissions from purchased wholesale water or wastewater services on behalf of our customers in our Scope 3 emissions (which were 11,568 tonnes for 2023) because we know these to be on a Net Zero journey of their own, which we do not have a strong influence over. These have increased by 19% from 9,731 tonnes in 2021, due to our continued growth in customers. However, all our emissions (including those from water wholesalers omitted) have been offset from 2021-23 through the purchase of carbon credits. We have included all other professional services purchased. From 2024 onwards, we will not buy credits in advance but will base the amount we buy on our carbon footprint calculated at the end of that year.

Scope 1

Direct emissions from sources owned or controlled by Everflow include stationary combustion equipment such as boilers, used for building heating. Refrigerants are used for cooling buildings.

Scope 3

All other indirect emissions from Everflow’s activities but from sources controlled by external organisations, e.g., mobile combustion from travel, outsourced services and purchased products, employee home working.

Workspace emissions

We moved our HQ from Wynyard Business Park to Whitehouse Business Park in Peterlee in April 2023. However, we were obliged to retain the leases for our previous buildings for most of 2023 and therefore, there were still some emissions associated with gas and electricity use in both their exclusive and shared facilities. Our new HQ has no gas supply, so is 100% heated by electricity. It also has air conditioning, which one of our previous HQs did not have.

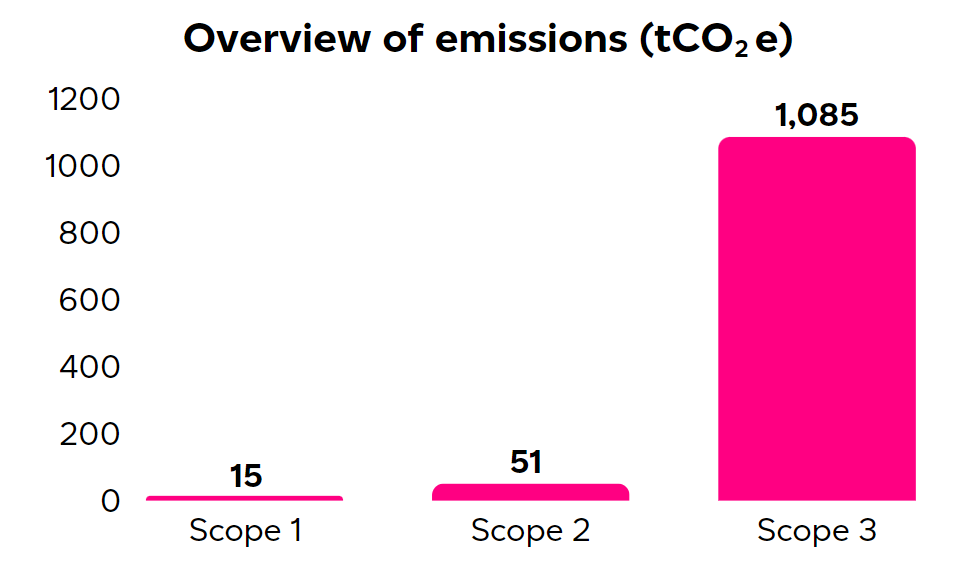

Our Scope 1 and 2 emissions are double our 2023 target (66 tonnes vs 37.5 target). However, no longer having leases at multiple HQs from 2024 will help reduce Scope 1 and we have already rectified large heating inefficiencies at Peterlee to reduce Scope 2. Our Scope 3 emissions have reduced 300 tonnes past their target (1,085 tonnes vs 1,393 target). Our total emissions have therefore surpassed their target by 280 tonnes (1,151 tonnes vs 1,431 target).

Scope 1

All our Scope 1 emissions were from natural gas on-site heating. We are pleased to report zero fugitive emissions of refrigerants from our landlords this year. This has resulted in our Scope 1 emissions reducing by 44% in 2023 - despite retaining the leases on previous buildings and our office space increasing by 93% (840m2). Top-ups of refrigerant in our offices which use air conditioning were responsible for 91% of our Scope 1 emissions in 2022. Happily, following pressure from us on our landlords and a move to a new HQ, none were required in 2023.

| Tonnes | CO2e | ||

| Scope 1 by greenhouse gas | 2023 | 2022 | Change |

| Carbon dioxide (CO2e) from on-site combustion | 14.56 | 2.23 | +552% |

| Hydrofluorocarbons (HFCs) from fugitive emissions of coolant (902 / 1,742)* | 0 | 23.59 | -100% |

| Total | 14.56 | 25.59 | -44% |

Scope 2

As our new HQ is entirely heated and cooled by electricity and we retained the old HQ leases in 2023, our Scope 2 emissions increased nearly four-fold.

Scope 3

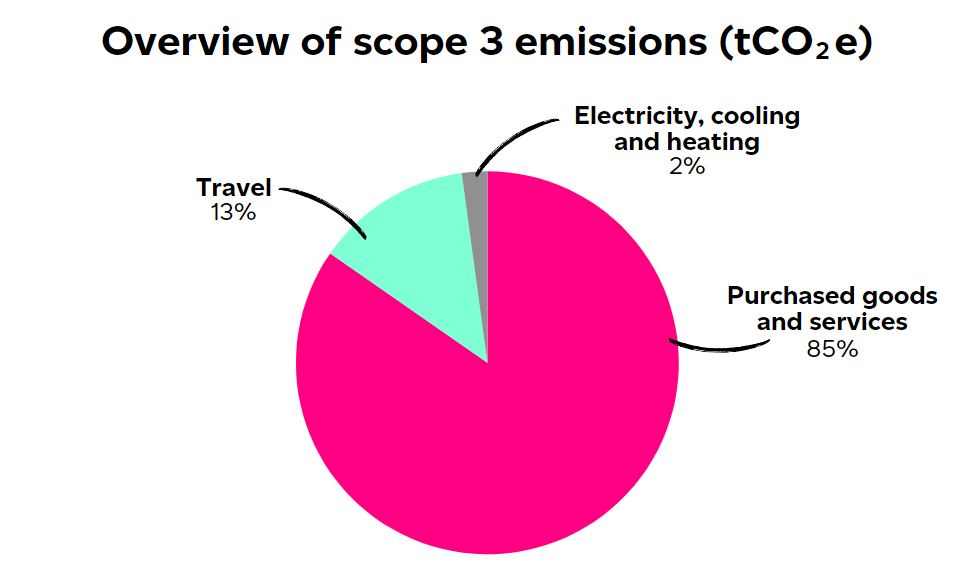

Scope 3 emissions are our largest contributor to our carbon footprint and are associated with our supply chain. We outsource a substantial amount of our operations. Therefore, influencing our supply chain is very important. However, how we travel (commuting and for business) also has a large impact and is more within our control.

Further Analysis

Purchased goods and services

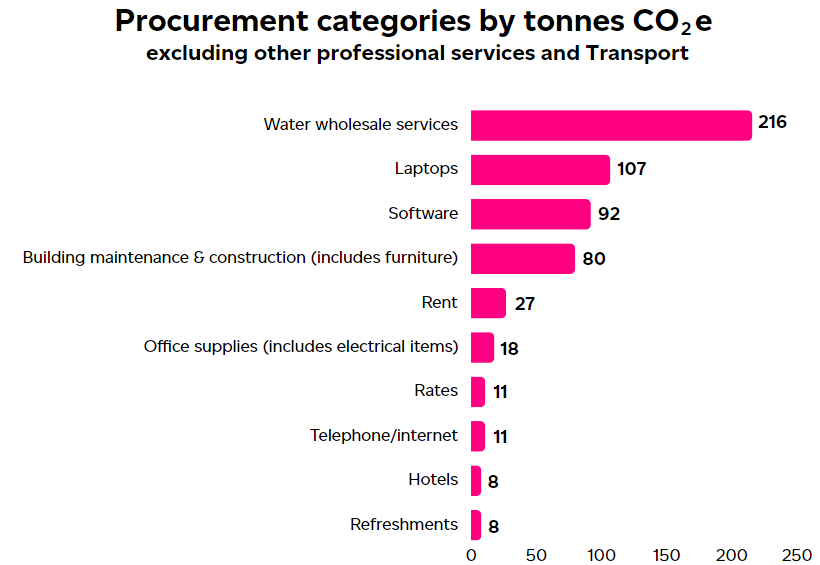

There was very little change in the total CO2e from this category in 2023 vs 2022. Most of our Scope 3 emissions were categorised as “Other professional services”. We categorised all those we had more oversight of below.

In 2023 we launched our commercial waste collections department and collected 1,423 tonnes of waste that year, generating 216 tonnes CO2e of emissions – more than a third of our purchased goods and services and twice as much as the next largest category. Waste collections involve a lot of transport emissions, while waste storage and processing represent a relatively small proportion. We used the spend based method to calculate emissions for 2023, which will be based on national averages of types of waste collected from households and businesses and how these streams are processed.

In 2024, we will collate more detailed information about the tonnes of waste we collect by stream (e.g. general waste, glass, cardboard, paper, food, metals and plastics) and the proportions of each stream processed by each method (combustion, anaerobic digestion, composting, open loop or closed loop recycling, reuse or landfill). In this way, we can drive processing emissions down. We will also work with our supply chain to gather their individual carbon footprints associated with our customers’ waste services and encourage them to reduce these in line with Net Zero principles.

In 2024 we launched our Telecoms directorate. Our partner in this field has an AA ESG rating from MSCI and we will offset emissions associated with customers using this utility.

How we purchase and reuse laptops still has a relatively large impact on emissions from purchased goods and services (representing a fifth of these), It is also one of the categories most in our control. Our Technology directorate is currently formulating an action plan to address the emissions associated with software, data and hardware. While significant emissions are associated with our software subscriptions, many of these suppliers will be too large for us to influence, and, as large businesses, we know many of them are already pursuing sustainability.

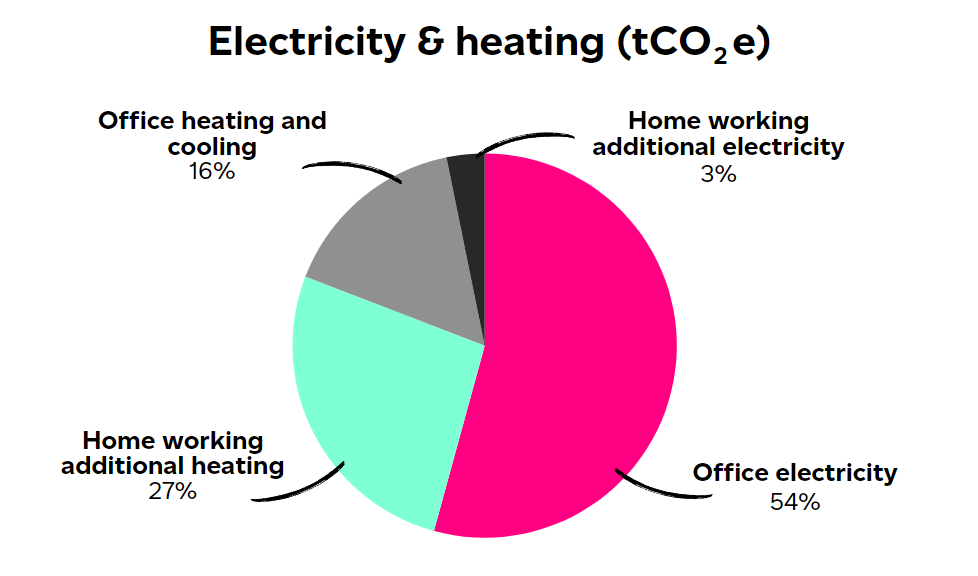

Electricity and heating

The proportion of our electricity and heating used on home working has stayed the same, but now a lot more is used on office electricity than on office gas and coolants, as we would expect as our new HQ has no gas and didn’t need refrigerant top-ups in 2023.

We have a hybrid working policy which allows employees to work from home some of the week. As well as calculating the carbon footprint of our office spaces, we have therefore included emissions associated with home working in our Scope 3 emissions. Unfortunately, increased home working does not directly translate into decreased heating and power bills at our offices. Most companies have not considered the increased emissions associated with employees working from home. However, we’ve calculated that these are, on average, offset by the decrease in employee commuting.

We carried out a detailed employee survey in January 2024 to understand how often employees worked from home and how employee’s home energy use varied when they did so. This had the added benefit of identifying actions we could take to help employees reduce their energy bills, and we issued advice the same month. The survey achieved a 65% response rate (117 responses). In 2022, 60% of our employees worked from home less than our company minimum of 2 days per week. This year, only 57% did.

This is reflected in the increased carbon emissions from home working, which has increased from 2.4 to 27 tonnes since 2022 (an 11-fold increase).

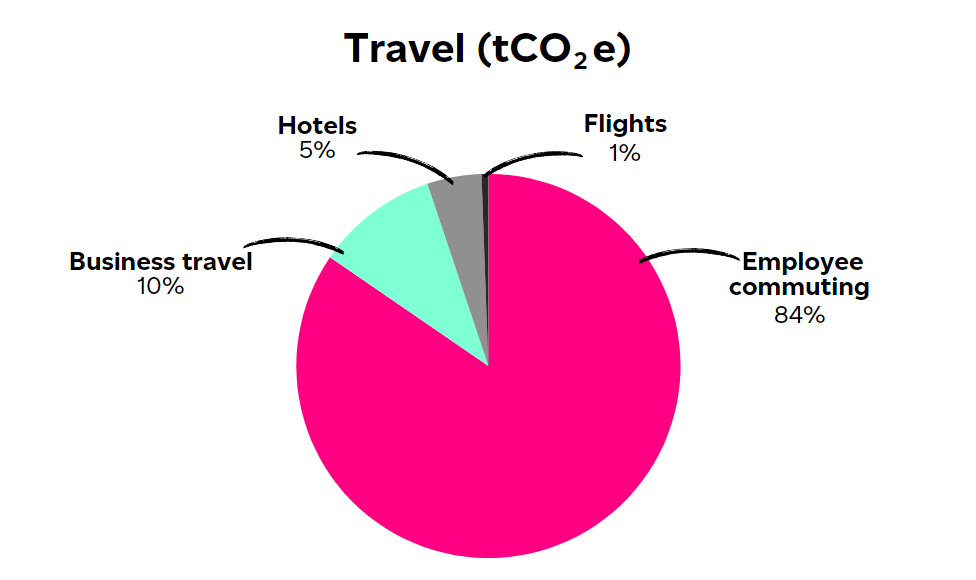

Travel

Most (84% - 148 tonnes CO2e) of our emissions associated with travel were from employee commuting. This has increased five-fold from 24 tonnes in 2022, despite the significant increase in home working.

Our January 2024 employee survey enabled us to estimate the total miles commuted by all employees with reasonable accuracy. The mean distance travelled to work was 18 miles (which increased from 14 miles before the move from Wynyard to Peterlee near Easter). However, the proportion travelling less than 20 miles to get to work remained at 45%.

A fifth of employees commuted by car to work 5 days a week in 2023, with 60% commuting by car 2/3 days per week.

In addition, 76% were driving alone vs 14% car sharing, only 4% using public transport and 3% cycling or walking. 2% were based remotely. 7 came by fully electric car and 4 by hybrid. 16 employees (14%) were already car sharing.

During 2022, we launched a salary sacrifice Electric Vehicle leasing scheme for our employees. 9 current employees have taken this opportunity to switch away from a fossil fuelled car. We also coordinated a car sharing matching scheme which 14% of car commuters used in 2023. In 2022, we also launched a hybrid working policy which allowed most employees to work from home 2-3 days a week. We calculate that every additional day per week that employees work from home should save 5 tonnes of CO2e from commuting, and add 4.5 tonnes of CO2e from additional heating and electricity use in the home, so a net half a tonne saving.

Regarding business travel, we identified that we could encourage greater use of greener hotels, public transport and car sharing when visiting other offices or travelling to other meetings and conferences, by revising our travel and expenses policy. This was launched in early 2023. In 2023, our employees drove a total of 158,950 business miles, generating 13 tonnes CO2e at a cost of £25,837 to the business. Most of the flights booked by the company are associated with one remote working Director, and their emissions are offset by the airline as standard.

In 2023, we located our new HQ more centrally in North East England and introduced a hybrid working policy to capture talent from the Newcastle area. Our latest survey found that two in three employees work from home at least two days per week. However, the HQ move has resulted in a large increase in carbon emissions from commuting. This will be due to the increase in staff and a nicer office environment. We have various initiatives to encourage collaborative working and good mental health, as well as comfortable, spacious spaces. Another cause is likely to be that we have moved further away from where some of our employees live. This could reduce as newer employees join who live closer to the new HQ.

Emission reduction activities in 2023

Selected initiatives include:

Supplier engagement

This was paused while we worked on a higher impact strategy, targeting our largest suppliers by spend. We launched our revised Procurement Policy to include scoring for different aspects of sustainability as well as cost.

Buildings energy consumption

We moved into our new HQ after Easter. Working with the landlord, the building achieved an energy performance certificate rating of A and does not use gas heating. Our previous offices were D-rated and we were obliged to retain our lease for one of these until the end of 2023.We worked with employees to find the optimum temperature and operation settings for the heating, ventilation, and cooling system. With a brand-new air-conditioning system, there were no fugitive emissions from escapes of refrigerant gases.

Technology

Sensor taps are used in Peterlee washrooms. Employee behaviour change posters displayed in Peterlee washrooms to spot and report leaks and save water. The landlord at Nuneaton installed efficient taps and toilets on the ground floor and plans to complete the building this year. We reused or recycled electronic equipment wherever possible, and disposed of it responsibly under waste electronics regulations (WEEE).

Reducing consumption and waste

We monitored energy and water use to identify usage spikes and potential leaks. We discovered the landlord had set heating to come on during the night during winter months and rectified the error in late 2023. Electricity sub meters were installed at Nuneaton office.

Employee travel and home working

Company-wide hybrid working policy promoted so employees can all work at least two days per week from home. We ran an annual employee survey on commuting and home working to identify ways to reduce related emissions. We issued fuel and energy saving advice to employees on commuting and home working. The EV salary sacrifice scheme was taken up by 7 employees. Car sharing encouraged in new Travel Policy, with 10% of employees commuting by car now sharing lifts. We continued to offer BiketoWork salary sacrifice scheme, but there was limited take-up (two people).

2040 targets

Methodology

Produced in accordance with the GHG Reporting Protocol – Corporate Standard method

For the period 01/01/2023 to 31/12/2023.

Data collected from primary information sources, including direct building manager interviews, employee surveys, employee FTE lists and official documents (bills, invoices and purchase ledger).

- Excludes emissions from purchased wholesale water and wastewater services on behalf of our customers (but we still offset these).

- Energy use in old Wynyard Park House office calculated using national office averages.

- Average waste disposal assumed for number of employees, sector and size of buildings.

- Emissions associated with procurement and services, including business travel without recorded mileage, and hotels, are based on expenditure and assigned SIC codes.

- Emissions associated with employee commuting based on distance by vehicle type.

- Employee commuting and home working emissions calculated for the sample who completed our annual survey (118 people) then estimated for entire workforce (172 FTE).

- Included optional emissions associated with working from home, including electricity T&E.

- Modelled using DEFRA Emission Factors 2023 and UK Consumption-Based Accounts Data 2022.

All our emissions (including those omitted above) were offset from 2021-23 through purchase of carbon credits. We will purchase credits to cover 2024 emissions at the end of 2024.

- Full-time equivalent (FTE) staff 172

- Square meters of office 1,742